Table of Contents

Introduction:

Tech IPO Boom takes on a new meaning after Figma’s sensational Wall Street debut. While shares skyrocketed 250% on opening day, industry insiders say the company may have left $3 billion on the table by underpricing its IPO. This bold outcome has investors, founders, and bankers buzzing with speculation: who’s next, and will they price smarter? Let’s dive into the implications, lessons from Figma, and the top names investors are watching in the IPO pipeline.

Figma’s IPO: A Success Wrapped in a $3 Billion Question

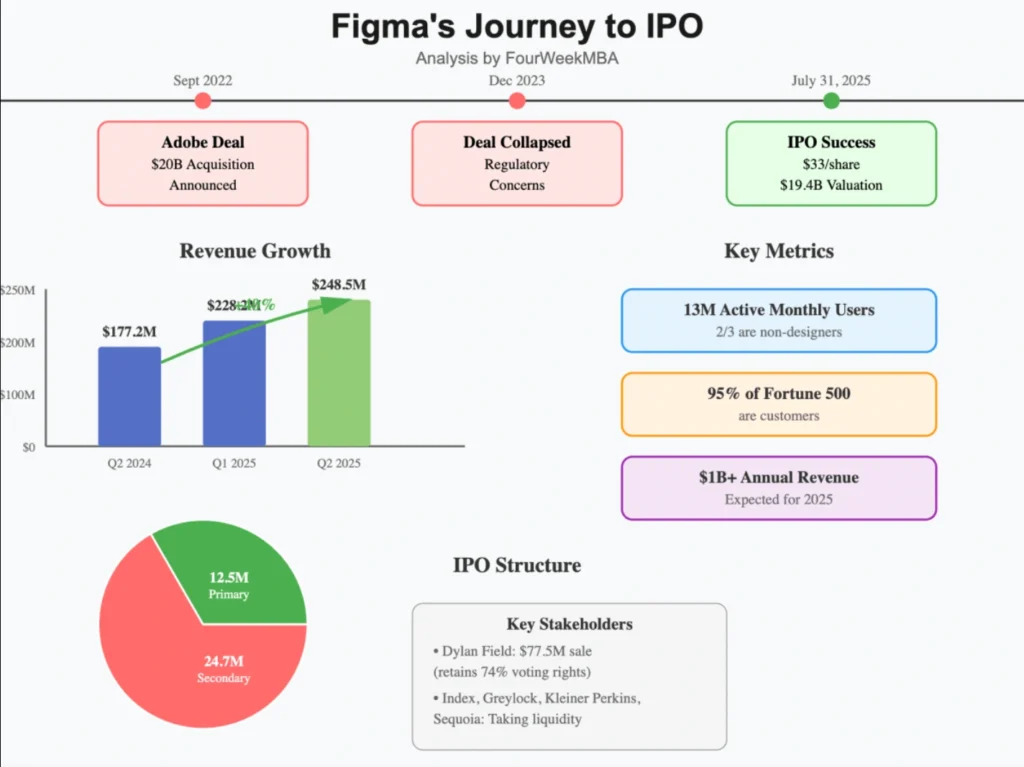

Figma’s IPO was one of the most talked-about public listings in recent years, and for good reason. The design software company priced its shares at $33 each, only to see them skyrocket more than 250% on the first day of trading. That kind of explosive growth is rare—and while it signaled intense investor demand, it also raised eyebrows on Wall Street. According to analysts, Figma and its selling shareholders may have left nearly $3 billion on the table due to underpricing. In other words, had the IPO been priced more in line with market appetite, the company could have raised significantly more capital without giving up additional equity.

This leads to a familiar debate in financial circles: the art versus the science of IPO pricing. Setting an IPO price isn’t just about numbers—it’s also about psychology, perception, and strategic signaling. Companies want to raise as much money as possible, but they also crave a “first-day pop” that shows the market is excited about their story. Typically, bankers aim for a 20% to 30% increase on day one. This range is considered ideal—enough to generate buzz and investor goodwill without suggesting that the offering was undervalued.

Figma’s 250% jump blew past that range, drawing attention to how much potential revenue was sacrificed for the sake of optics. Was it worth it? That depends on who you ask. For existing investors and insiders, the soaring stock price adds enormous paper value to their holdings. For the company itself, however, a higher initial price could have meant billions in additional cash for R&D, talent acquisition, or global expansion. The IPO was undoubtedly a win in terms of visibility and validation—but it also underscores a growing concern in Silicon Valley and on Wall Street: whether companies and their advisors are getting the pricing strategy right in an era where demand can wildly outpace expectations.

What the Figma IPO Signals for the Tech IPO Boom

Figma’s extraordinary IPO performance has sent a strong signal across the tech industry: investor appetite for high-growth, venture-backed companies is not only alive—it’s surging. After a long period of caution following the 2022 tech sell-off and interest rate hikes, public markets appear to be warming back up to innovation-driven businesses. Figma’s success is a clear indicator that investors are once again willing to bet big on software companies with strong product-market fit, sticky user bases, and scalable business models.

The impact of this momentum goes far beyond Figma itself. For companies like Stripe, Databricks, Reddit, and Canva—who have long been considered IPO candidates—the message is clear: the window for going public may be opening wider in 2025. Figma’s rapid gains are likely to influence how these companies approach their own IPO strategies. Expect more founders and CFOs to engage in deeper discussions around pricing, timing, and the trade-off between short-term capital raised and long-term shareholder value. Figma’s experience might prompt some firms to consider alternative models like direct listings or hybrid IPOs to capture more value up front.

Looking ahead, the broader market sentiment is also shifting. With interest rates stabilizing and inflation cooling in many regions, 2025 could shape up to be the biggest IPO year since the 2021 peak. A successful public debut is no longer viewed solely as an exit strategy—it’s also a branding moment and a growth catalyst.

In the venture capital world, Figma’s IPO has sparked both celebration and caution. On one hand, it validates the long-game thesis many VCs have held through market downturns. On the other, it reignites concerns about leaving money on the table and whether traditional IPO pricing benefits founders and investors equally. Expect more scrutiny from VCs in future pricing rounds—and perhaps a push for tighter alignment with bankers to avoid missing out on billions in potential gains.

Likely Contenders Riding the IPO Wave

With Figma’s IPO reigniting confidence in the public markets, attention is now turning to a handful of high-profile tech companies that many believe are next in line to go public. Leading the pack is Stripe, the fintech giant whose infrastructure quietly powers a large portion of the internet’s payment systems. Despite remaining private for over a decade and raising billions in funding, Stripe has faced mounting pressure from investors to list. With a strong business model, global footprint, and deep enterprise integration, Stripe’s IPO could easily become one of the largest fintech offerings in history.

Another major player drawing attention is Reddit, the community-driven platform known for its passionate user base and unique position in internet culture. While Reddit’s monetization model has evolved more slowly than peers, its engagement metrics are impressive, and its influence on media and markets (as seen in the GameStop saga) gives it a compelling narrative. A Reddit IPO would likely be more than just a financial event—it would be a cultural moment.

In the realm of AI and data, Databricks stands out as a powerhouse. Backed by major VC firms and tech giants, Databricks combines artificial intelligence with big data to serve large-scale enterprise needs. As AI adoption accelerates across industries, Databricks has positioned itself as a central enabler of that shift, making its IPO highly anticipated by institutional investors looking for exposure to enterprise AI.

Finally, there’s Canva, the design platform that has democratized visual content creation for millions of users worldwide. With strong revenue growth, viral user adoption, and a business model that scales across both individuals and enterprise teams, Canva is often referred to as “Australia’s tech unicorn” with global reach. Its branding, market dominance in its category, and profitability potential make it a strong IPO candidate, especially in the wake of Figma’s success.

Collectively, these companies represent the next wave of IPO hopefuls—each bringing something unique to the table, and each standing to benefit from the renewed enthusiasm sparked by Figma’s market debut.

IPO Pricing Lessons for Founders and Bankers

Figma’s IPO reignited a long-standing debate in startup and banking circles: should companies prioritize market buzz or maximize capital when pricing their public debut? The allure of a dramatic first-day stock surge is tempting—media coverage, employee morale, and investor excitement often follow a strong “IPO pop.” For many founders, this immediate momentum is worth more than squeezing out every dollar in the offering. A successful first day can also attract long-term institutional interest and elevate brand visibility, positioning the company as a category leader.

But there’s a trade-off. Overly conservative pricing, like Figma’s 250% day-one surge, can cost companies billions in unrealized capital—funds that could have been used for hiring, product development, or international expansion. On the flip side, aggressive pricing that overshoots demand can lead to weak post-IPO performance, which undermines confidence and affects long-term valuation. Founders and CFOs must now navigate this delicate balance carefully, especially in a market that punishes hype and rewards sustainable growth.

Another growing concern is investor fatigue, especially when multiple tech IPOs crowd the market within a short time frame. When expectations are too high, even solid performances can feel underwhelming. That’s why transparency and trust in the valuation process are more critical than ever. Investors need to understand how a company arrived at its price, and founders must have confidence that their underwriters are aligning incentives rather than playing it safe to please institutional clients.

Figma’s IPO may have been a spectacular success, but it also serves as a powerful case study. It reminds future founders and bankers alike that pricing is not just a financial decision—it’s a strategic one, with ripple effects that can shape a company’s future for years to come.

What’s Next for the IPO Market After Figma?

Figma’s eye-catching IPO has already begun to reshape how tech companies—and their bankers—approach going public. The story of leaving $3 billion on the table is now a case study being dissected in boardrooms and VC meetings alike. This level of underpricing has forced many founders and CFOs to reconsider the traditional IPO model and ask hard questions: Are banks being too conservative in their pricing strategies? Are they protecting institutional investors at the expense of the companies they represent? The result could be a shift toward more aggressive pricing tactics in upcoming IPOs, particularly for high-demand companies with strong fundamentals.

On the flip side, Figma’s IPO may also trigger caution. The fear of mispricing—either too high or too low—could prompt some companies to delay their listings or explore alternatives like direct listings or SPACs to retain more control. There’s also the possibility that regulators and public markets watchdogs begin to scrutinize pricing methods more closely, especially if underpricing continues to be seen as a structural flaw in the IPO system rather than a one-off anomaly.

Beyond capital and valuations, companies are increasingly recognizing that an IPO is more than just a liquidity event—it’s a brand moment. Figma’s debut generated massive publicity, helped solidify its status as a category leader, and even attracted talent and partnership interest. As more tech firms prepare to go public in 2025, we’re likely to see IPO strategies that blend both financial precision and brand storytelling, ensuring that the first day on the market is not just profitable—but unforgettable.

Conclusion: The Tech IPO Boom Is Just Getting Started

Figma’s spectacular IPO wasn’t just a win for one company—it was a wake-up call for the entire tech and financial ecosystem. It showed that demand for innovative, high-growth companies is back with force, but it also exposed the cracks in the traditional IPO pricing playbook. As the next wave of IPO-ready giants like Stripe, Reddit, and Databricks prepare to take the stage, founders and investors alike must rethink their strategies—not just to ride the momentum, but to capture their company’s full value.

The tech IPO boom is more than a trend; it’s a shifting landscape where valuation, brand, and public perception collide. With billions at stake, the lessons from Figma will shape how companies go public in 2025 and beyond. The challenge now? Getting the balance right—between excitement and execution, between underpricing and overpromising, and between going public and going viral.